Breaking Down Your Financial Aid Letter: What’s Free Money and What’s Not

CFAA College Financial Aid Advisors

MARCH 17, 2025

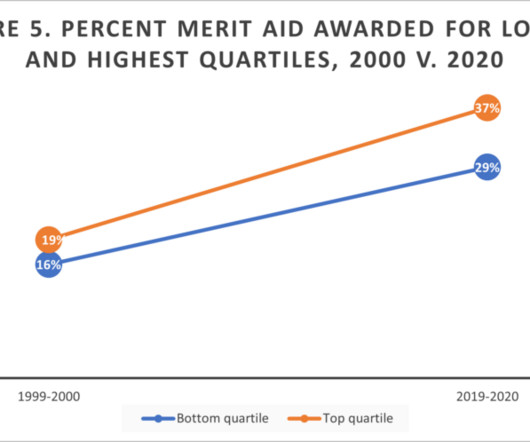

Receiving your financial aid letter is a huge milestone in your college journey, but it can also be overwhelming. Heres your financial aid breakdown: Free Money: Grants and Scholarships Grants and scholarships are the best parts of your financial aid package because they dont require repayment.

Let's personalize your content