Pell Grant Increase Will Help Low-Income Students, But More is Needed

Diverse: Issues in Higher Education

JANUARY 4, 2023

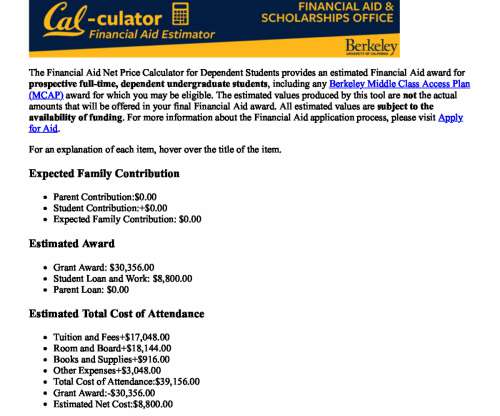

29, the new federal spending plan is set to increase the Pell Grant in 2023, allowing low-income students a chance to access up to $7,395 each year. Coupled with the $400 increase in the 2022 fiscal year, this is the largest two-year increase ever in the history of the grant. The total student loan debt reached $1.75

Let's personalize your content